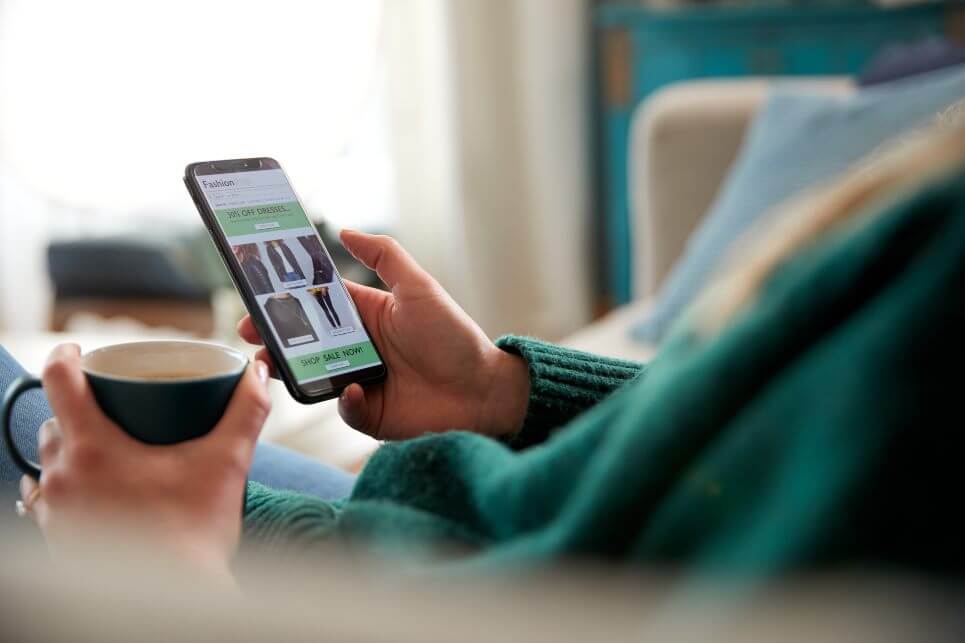

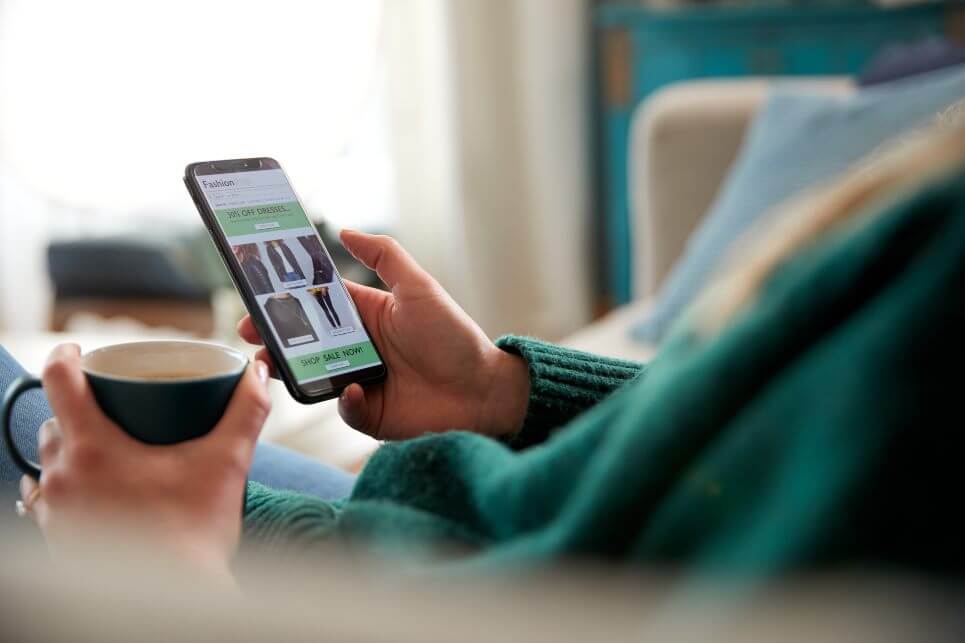

Online shopping has grown exponentially over the past two decades - and there are numerous reasons why. Compared to in-person shopping, it's more convenient, there's a greater range of brands and products available, and there are generally better savings to enjoy.

The latter point is a particularly enticing aspect of shopping online. As they typically operate with lower costs than their physical counterparts, online retailers are able to pass these savings onto their customers by offering products and services at lower prices.

Yet, there are extra ways to bag a bargain through your desktop or smartphone. With the following ten tips and tricks, here's how to save money when shopping online:

Continue reading "How to Save Money When Shopping Online: 10 Tips and Tricks" →